留学生论文Business paper代写参考-苹果的市场结构。本文是一篇由本站代写服务提供的留学生论文代写参考。主要内容是讲述苹果是一家领先的跨国公司,每天都在推出大量的科技产品。这家总部位于美国的公司已经在世界各地推出了自己的产品。最近,苹果公司宣布开发“超级平板电脑”。本篇留学生论文根据市场调查表明,客户对这项新技术的要求很高。在过去的七年里,苹果凭借其富有想象力和新颖的商业方式取得了巨大成功。留学生论文指出通过不断创新,苹果开发出了一系列富有想象力的设计和风格的卓越产品。在现代技术创新中,苹果公司在信息技术世界的扩张中迈出了合理的步伐。这种扩张也迫使其为数不多的竞争对手在竞争激烈的市场上蓬勃发展并生存下来。下面就一起来看一下这篇留学生论文Business paper代写参考的具体内容。

Apple (Iphone) is one of the multinational leading company introducing tremendous technology gadgets day by day. All over the world, this US based company has introduced its products. Recently, Apple has a pronouncement of development of “super tablet” computer. Market researches show that customers’ demands are high for this new technology item. Over the past seven years, Apple has seen great success due to its imaginative and fresh way to do the business. Through continuous innovation, Apple has developed a series of exceptional products with imaginative design and style. In modern technology innovations, Apple Inc. has made reasonable steps in the expansion of information technology world. This expansion also forced its few competitors to boom and survive in the market with due competition

In my points of view, Apple Inc. can be considered stand in difference market structures such as oligopoly and monopolistic competition. Apple Inc. maintains oligopoly market structure in the competition of smart phone brands announcements,but Apple Inc. is known as monopolistic competition in the branded computers. Monopolistic competition in which many sellers are producing highly differentiated products. Monopolistic competition is also known as monopsonistic competition. Monopsonistic competition describes the demand-side seems to be parallel and peer to the monopolistic competition on the supply side.

本篇留学生论文认为,苹果公司可以被认为是处于不同的市场结构,如寡头垄断和垄断竞争。苹果公司在智能手机品牌公告的竞争中保持着寡头垄断的市场结构,但公司在品牌电脑的竞争中被称为垄断竞争。垄断竞争,许多卖家生产高度差异化的产品。垄断竞争也称为垄断竞争。垄断竞争描述了需求侧似乎与供应侧的垄断竞争平行和对等。

Some economist states that monopolistic competition is more realistic than perfect competition because products produced by the competitors are heterogeneous (non – homogenous). Imperfect competition does not operate under strict and stringent procedures of perfect competition. In this market scenario of imperfect competition, the entity enjoys the comfort of increasing the price in order to earn maximum profits. Apple Inc. sells the un–identical technology in the market. This enables them to survive in the market effectively and efficiently.

一些经济学家指出,垄断竞争比完全竞争更现实,因为竞争对手生产的产品是异质的(非同质的)。不完全竞争不是在严格的完全竞争程序下运作的。在这种不完全竞争的市场场景中,实体享受着提高价格以获得最大利润的舒适感。苹果公司在市场上销售不完全相同的技术。这使他们能够有效地在市场上生存。

Compare to oligopoly, monopolistic competition has more competitors, thus the apple’s “super tablet” computer is considered as a monopolistic competition. Many other branded computer companies like Samsung, HTC and Dell are strong competitors that share a mobile and tablet computers market internationally. The sales revenue generated by such competitive companies is close enough to Apple inc. that keeps themselves stay competitive. As the name ensure, competitive industry of imperfect nature

与寡头垄断相比,垄断竞争有更多的竞争对手,因此苹果的“超级平板”电脑被视为垄断竞争。许多其他品牌电脑公司,如三星、HTC和戴尔,都是在国际上共享移动和平板电脑市场的强大竞争对手。这些具有竞争力的公司所产生的销售收入与苹果公司相当,这使他们保持了竞争力。顾名思义,竞争性行业性质不完善

Characteristics:特点

Monopolistic competitive market represents the following attributes:垄断竞争市场具有以下特征

There are many producers and many consumers in this approach. Thus, low concentration ratio. For example, the percentage of total sales of industry made by few significant sellers in the industry market.这种方法有许多生产者和许多消费者。因此,浓度比低。例如,行业市场中少数重要卖家在行业总销售额中所占的百分比。

Consumers perceive that there is non-price differences among the competitors’ products i.e. there isproduct differentiation. There is a high non price competition.消费者认为竞争对手的产品之间没有价格差异,即存在产品差异。非价格竞争激烈。

Producers have control over price- they are not “price takers” but the “price makers. This competitive edge provides the entity an opportunity to influence their economic periods.生产者可以控制价格——他们不是“价格接受者”,而是“价格制定者”。这种竞争优势为实体提供了影响其经济时期的机会。

There are fewbarriers to entry and exit. Unlike monopoly, there are no any restrictions to enter in the competitive environment. This means that the short run supernormal profit will bring other producers into the industry sector, and so normal profits only are made in the long run.出入境的障碍很少。与垄断不同,进入竞争环境没有任何限制。这意味着短期的超正常利润将把其他生产商带入工业部门,因此正常利润只能从长期来看。

Apple Inc. executes and carries independent action. There is in mutual interdependence concept in the competitive companies.苹果公司执行并执行独立行动。竞争企业中存在着相互依存的概念。

All entities’ objective is to boost up their profits for a number of periods. And the customer tries to maximize welfare by their purchase form such companies.所有实体的目标都是在一定时期内提高利润。客户试图通过从这些公司购买来实现福利的最大化。

One assumption in this type of market structure is that all the factors of production are mobile. If they are not consumed effectively and efficiently, they could move to any other place where they want to be to fulfill their aims.这种市场结构中的一个假设是,所有的生产要素都是流动的。如果他们没有得到有效和高效的消费,他们可能会搬到任何其他他们想去的地方来实现他们的目标。

Priority reason among Competitors:竞争对手中的优先级原因

Monopolistic competition (Imperfect competition) is the terminology for competitive markets that do not match the requirements of perfect competition. They are competitive, but they are imperfect. Many of the markets in real life can be considered as imperfect competition. Market structures with no competition (monopoly) are excluded. Each participant knows the strengths and weakness of its other competitors as well. Many markets operate among the few competitors. In such markets, a participant may gain advantage by offering a quality product that is just a little better than other competitors–not the best product but the little better product. Such competition usually leads to an efficient use of scarce resources. . High profits encourage the new competitors to enter in the market and those who faces losses, leave the market.

留学生论文给予解释垄断竞争(不完全竞争)是指不符合完全竞争要求的竞争市场。他们很有竞争力,但并不完美。现实生活中的许多市场都可以被视为不完全竞争。不包括没有竞争(垄断)的市场结构。每个参与者都知道其他竞争对手的长处和短处。许多市场在为数不多的竞争对手中运作。在这样的市场中,参与者可能会通过提供比其他竞争对手稍好的优质产品来获得优势——不是最好的产品,而是稍好的产品。这种竞争通常会导致稀缺资源的有效利用。高利润鼓励新的竞争对手进入市场,而那些面临亏损的竞争对手则离开市场。

Imperfection and inefficiency 缺陷和低效

Sometimes, monopolistic competition cannot efficiently use their allocated sources. They become inefficient because they mostly depend on market control if any other competitor takes the higher rank by wonderful product introduction. Monopolistic competitive entities have modest level of market control whereas oligopolistic companies have strong degree of market control.

有时,垄断竞争无法有效利用其分配的资源。他们变得效率低下,因为如果有其他竞争对手通过出色的产品介绍获得更高的排名,他们主要依赖于市场控制。垄断竞争实体的市场控制水平适中,而寡头垄断公司的市场控制程度很强。

Analysis of Apple Inc. with other Competitive Companies 苹果公司与其他竞争公司的比较分析

Apple has an “i” for revolutionary technology.Since its release, the company’s I‑Phone hasmade a revolutionarychange in the market of cell phones and mobile, tablet computing. One of its popular products, iPadtablet computerhasbecome another twirl change in thetechnology market. In past few years, it was stated that Samsung is a strong competitor to Apple Inc. and engaged in a rivalry relationship. Many economist crews said, Samsung will knock down the Apple Inc. and get the top position as a leading company in the modern era of technology.

苹果对革命性技术有一个“i”。自发布以来,该公司的I‑Phone在手机和移动平板电脑市场发生了革命性的变化。iPadtablet电脑是其最受欢迎的产品之一,它已经成为科技市场的又一个转折点。在过去的几年里,有人说三星是苹果公司的强大竞争对手,并处于竞争关系。许多经济学家表示,三星将击败苹果公司,成为现代科技的领军企业。

Samsung is known as a company whose key strategy is to use economies of scale to gain a competitive advantage. Here is the comparison of both companies regarding their economies of scale that shows that a minor difference in the identical products introduced by Apple Inc. and Samsung may award the great profit to other:

众所周知,三星的主要战略是利用规模经济来获得竞争优势。以下是两家公司在规模经济方面的比较,表明苹果公司和三星推出的相同产品之间的微小差异可能会将巨大利润奖励给其他公司:

Dichotomy in the makeup of Products 产品构成中的二分法

Apple gets its 15% market share with just three models of phones or tablets. While Samsung takes 30% of the market, it must produce 150 models of smart phones to do so. We can analyze that Apple averages 50 MU per handset model while Samsung averages just 2 MU per model. That’s a 25x difference!

苹果仅凭三种型号的手机或平板电脑就获得了15%的市场份额。虽然三星占据了30%的市场份额,但它必须生产150款智能手机才能做到这一点。我们可以分析,苹果平均每款手机50 MU,而三星平均每款仅2 MU。这是25倍的差距!

More volume of products awards a cost advantages in electronics hardware to the competitive leader. Software development and maintenance becomes complex when it has to fix on a broad range of hardware items. It is amazing to compare that Samsung can depreciate the cost of 150 models of phones across 300 MU as profitably as Apple can amortize the cost of just 3 phones across 150 MU.

更多的产品数量将电子硬件的成本优势授予了具有竞争力的领导者。当必须修复广泛的硬件项目时,软件开发和维护会变得复杂。令人惊讶的是,三星可以将150款手机的成本在300 MU上贬值,就像苹果可以将3款手机的价格在150 MU上摊销一样有利可图。

Short run Approach for Competitive Entities 竞争实体的短期方法

In monopolistic competition, both Apple Inc. and Samsung can behave like monopoliesin the short run, including using market power to generate profit. In the short-run approach, both Apple Inc. and Samsung can normally gain some abnormal profit. But over the long run approach, other competitive companies shall enter in the market due to the low entry barriers. New entries will try to get the competitive edge on the existing companies and try to grab the significant market share in terms of profit. It is assumed that Short run is a time period in which at least one factor of production is fixed.

在垄断竞争中,公司和三星在短期内都可以表现得像垄断企业,包括利用市场力量创造利润。本篇留学生论文认为从短期来看,苹果公司和三星通常都能获得一些异常利润。但从长远来看,由于进入壁垒较低,其他有竞争力的公司也会进入市场。新的参赛者将试图获得现有公司的竞争优势,并试图在利润方面抢占巨大的市场份额。假设短期运行是至少一个生产要素固定的一段时间。

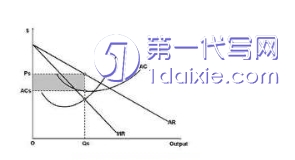

To earn maximum profits over Samsung, Apple Inc. should produce quantity Qs at price Ps. The firm produce the products where marginal cost (MC) and marginal revenue (MR) curves will meet, because MC is the cost of producing an one more (additional item) of the good and MR is the revenue of selling one more good and their intersecting point shall be most efficient production in favor of Apple Inc. This means that the shaded area between Ps, ACs (average production cost of one item at this defined quantity) and the AR curve (average revenue curve) is the abnormal profit that the Apple Inc will enjoy. AR is equivalent to the demand curve and is the average revenue the Apple Inc. will earn on sold of one item. Production on this point shall award maximum profits for the Apple Inc.

本篇留学生论文认为为了获得超过三星的最大利润,苹果公司应该以Ps的价格生产数量Qs。该公司生产的产品将满足边际成本(MC)和边际收入(MR)曲线,因为MC是再生产一件商品(附加商品)的成本,MR是再销售一件商品的收入,它们的交叉点应该是有利于苹果公司的最高效生产。这意味着P、AC(在这个定义数量下一件商品的平均生产成本)和AR曲线(平均收入曲线)之间的阴影区域是苹果公司将享受的异常利润。AR相当于需求曲线,是苹果公司出售一件商品的平均收入。在这一点上的生产将为苹果公司带来最大利润。

Thus, equilibrium is created in the short run. For maximum profit, Samsung or Apple Inc. both firms have to produce quantity of goods at point Qs where marginal revenue curve coincides with the marginal cost curve. If the company face losses in the short run, such company will quit from competition race and the remaining firms will meet the higher demands on the will of entities on price.

因此,平衡是在短期内产生的。为了获得最大利润,三星和苹果公司都必须在边际收入曲线与边际成本曲线重合的Qs点生产一定数量的商品。如果公司在短期内面临亏损,这类公司将退出竞争,剩下的公司将满足实体对价格意愿的更高要求。

Whereas in the long run approach, it is impossible to earn abnormal profits because of the features and assumption of Monopolistic competition. There are a few large firms, but many small firms that will compete for profit and thus company shall be bound to deflate its prices to achieve targets. Another factor, other competitors of Apple Inc. and Samsung due to low entry barriers in the market structure will enter into the market and further add competition for market share. Finally, the goods are similar enough to ensure that competition will always remain high. The one, who makes slighter difference as said early, will earn maximum profits and achieve not only its primary objectives but the secondary also.

留学生论文认为而从长期来看,由于垄断竞争的特点和假设,不可能获得异常利润。有一些大公司,但许多小公司将竞争利润,因此公司必然会降低价格以实现目标。另一个因素是,苹果公司和三星的其他竞争对手由于市场结构的低进入壁垒将进入市场,并进一步增加市场份额的竞争。最后,商品的相似性足以确保竞争始终居高不下。正如前面所说的那样,一个稍微有所作为的人,将获得最大的利润,不仅实现其首要目标,而且实现其次要目标。

The price of items to be sold plays a key and vital role in establishing an efficient and effective allocation of resources in a market system. Price acts as a sign for surplus and deficit which assist the company respond to changing market conditions and field forces. Apple Inc. should consider the price of super tablets in order to achieve optimum benefits and positive result relevant to their economic concerns. Pricing also plays vital role as a competitive edge to help a business to extract market opportunities.

待售物品的价格在市场体系中建立高效和有效的资源分配方面发挥着关键和至关重要的作用。价格是盈余和赤字的标志,有助于公司应对不断变化的市场条件和实地力量。苹果公司应该考虑超级平板电脑的价格,以实现最佳效益和与其经济利益相关的积极结果。定价作为竞争优势也发挥着至关重要的作用,有助于企业获得市场机会。

Theory of price describes that the market price will show intercourse between two opposing concepts. At one side are demand considerations depending on marginal utility; while on the other side are supply considerations that depend on marginal cost. An equilibrium price is supposed to be equal to marginal utility (counted in income units) from the consumer’s perspective and marginal cost from the seller’s side. Every economist accepts this viewpoint, and it defines the gist of economics mainstream, recently this concept has been challenged seriously.

价格理论描述了市场价格将表现出两个对立概念之间的互动。一方面是取决于边际效用的需求考虑;而另一方面是取决于边际成本的供应考虑。从消费者的角度来看,均衡价格应该等于边际效用(以收入单位计算),从卖方的角度来看等于边际成本。每一位经济学家都接受这一观点,并由此界定了经济学主流的要旨,这一概念近年来受到了严峻的挑战。

Importance of Price in Apple Inc. Economy 价格在苹果公司经济中的重要性

In the given scenario, management of Apple Inc. has conducted a recent research for the new “super tablet” computer. Consumers demand seems to be high for this electronic item as per research results and the supply of super tablet is reduced, this will boost up the price.

在这种情况下,苹果公司管理层最近对新型“超级平板电脑”进行了研究。根据研究结果,消费者对这种电子产品的需求似乎很高,而超级平板电脑的供应减少,这将推高价格。

Price stability of product in a long run approach may have also positive outcomes on the profits of Apple Inc. Price stability means to avoid the increase and decrease of that electronic item to be sold. Following points encourages avoids the negative results of economies of scale:

从长远来看,产品的价格稳定性也可能对苹果公司的利润产生积极影响。价格稳定性意味着避免将要出售的电子产品的增加和减少。留学生论文提出以下几点鼓励避免规模经济的负面结果:

Price stability shall chip in to achieve high levels of economic activity ;价格稳定应发挥作用,以实现高水平的经济活动;

Increase the limpidity of the price mechanism of super tablet. People can find changes in relative prices (i.e. prices between different products and articles), without being untidy by changes in the overall price dimensions of competitors similar electronic items;提高超级平板电脑价格机制的透明度。人们可以发现相对价格(即不同产品和物品之间的价格)的变化,而不会因竞争对手类似电子产品的整体价格维度的变化而混乱;

Encourage buyer to make high demands and to use his scarce resources more effectively and efficiently by comparisons with strong competitors;鼓励买方提出高要求,并通过与强大的竞争对手进行比较,更有效地利用其稀缺资源;

Discourages useless exertion to draw barrier against the negative impact of inflation or deflation;不鼓励无用的努力来消除通货膨胀或通货紧缩的负面影响;

Avoids contortions of inflation or deflation, which can have worse impact on economic behavior of social security systems and taxation requirements;避免通货膨胀或通货紧缩的扭曲,这可能会对社会保障体系的经济行为和税收要求产生更严重的影响;

Preventing an imperious division of wealth and income as a result of unexpected deflation or inflation.防止由于意外的通货紧缩或通货膨胀而造成财富和收入的过度分配。

Thus, price of super tablet charged by Apple Inc. is the most important business decisions management has to make for the achievement of budgeted profits.For example, unlike the other units of the marketing mix (product, place & promotion), pricing decisions affect the revenue or sales figure than the cost factor. Pricing also requires being congruent with the other elements of the marketing mix, since it shapes to the perception of a product by consumers. In short, setting a price of super tablet that may too high or too low will limit the growth of a business. At worst, it may result serious paradox for sales and cash flow of Apple Inc.

因此,苹果公司超级平板电脑的价格是管理层为实现预算利润而必须做出的最重要的商业决策。例如,与营销组合的其他单元(产品、地点和促销)不同,定价决策影响的是收入或销售额,而不是成本因素。定价还需要与营销组合的其他元素相一致,因为它取决于消费者对产品的感知。简而言之,将超级平板电脑的价格定得过高或过低都会限制业务的增长。在最坏的情况下,这可能会给苹果公司的销售额和现金流带来严重的悖论。

Market force Analysis in Long run approach 长期方法中的市场力量分析

Market forces can be explained as way that the behavior of Apple Inc (seller) and buyers affects the price and wages levels, without any government intervention. Marketing mix (product, place and promotion) seems to be more important than price, and thus requires more attention of Apple Inc., but determining the price of “super tablet” is actually one of the most important decisions of management. This robust concept introduces the competitive forces in the market and ensures that innovation in the inventions of Apple Inc. in the form of “super tablet” is at the frontline of any industry policy.

留学生论文认为市场力量可以解释为,在没有任何政府干预的情况下,苹果公司(卖方)和买方的行为会影响价格和工资水平。营销组合(产品、地点和促销)似乎比价格更重要,因此需要苹果公司更多的关注,但确定“超级平板电脑”的价格实际上是管理层最重要的决定之一。这一强大的概念引入了市场竞争力量,并确保苹果公司以“超级平板电脑”的形式进行的发明创新处于任何行业政策的前沿。

In long run, demand and supply forces represents the whole influence on buyers and sellers on quantity and price of the super tablets offered in the market. In general,excessive demand may result increase in price and quantity, and excess supply causes it to fall. In particular, market researchers should examine changing patterns in customer demands which may show that a longer term change in economy is occurring. Changes that continue over a long term approach may be included as a portion of the business cycle of an economic period. When economic forces are restricted, supply and demand decides the prices of goods and Prices. As a result, force businesses what to produce; if people want more of a particular item, the price of the good rises.

留学生论文指出从长远来看,需求和供应力代表了买方和卖方对市场上提供的超级平板电脑的数量和价格的整体影响。一般来说,过多的需求可能导致价格和数量的增加,而过多的供应会导致价格和量的下降。特别是,市场研究人员应该研究客户需求的变化模式,这可能表明经济正在发生长期变化。长期持续的变化可以作为经济时期商业周期的一部分。当经济力量受到限制时,供应和需求决定了商品的价格和价格。因此,迫使企业生产什么;如果人们想要更多的特定商品,商品的价格就会上涨。

Some of the advantages and disadvantages of market forces are entailed below:市场力量的一些优点和缺点如下

Advantages:优点

Apple Inc. may produces a wide range of super tablets to meet the buyers’s wants 苹果公司可能会生产多种超级平板电脑来满足买家的需求

The market force responds instantly to consumer’s wants 市场力量对消费者的需求做出即时反应

Market system promotes the use of new and improved techniques and machines to produce improved version of super tablets 市场体系促进使用新的和改进的技术和机器来生产改进版的超级药片

Disadvantages:缺点

factors of production will be used if profit is earned at level required 如果利润达到所需水平,将使用生产要素

the free market can fail to provide certain items due to inherent market limitations 由于固有的市场限制,自由市场可能无法提供某些商品

the free market may promote the use of harmful goods that may result in litigation and claims 自由市场可能会促进有害商品的使用,从而导致诉讼和索赔

the production’s social effects and needs may be filtered 生产的社会影响和需求可能会被过滤掉

the market structure allocates more products to those buyers who are financially strong 市场结构将更多的产品分配给那些经济实力雄厚的买家

When prices are not allowed to increase in comparison with market level, suppliers may not provide demanded “super tablet” computers as buyer want. In simple words, shortages of super tablet computers will be found in the market. These shortages become serious sometimes. Nevertheless, if prices set are low than market level, more consumers shall be able to buy the electronic item. When Apple Inc. management does not allow reducing their price from market level, suppliers may supply more electronic items than consumers needs.

当价格不允许与市场水平相比上涨时,供应商可能不会按照买家的要求提供所需的“超级平板电脑”。简单地说,市场上将出现超级平板电脑的短缺。这些短缺有时会变得严重。然而,如果设定的价格低于市场水平,那么更多的消费者将能够购买电子产品。当苹果公司管理层不允许从市场水平降低价格时,供应商可能会提供比消费者需要的更多的电子产品。

Market gives necessary information for both seller and buyers to make important decisions for the daily market deals. This is a universal rule that we need things from others and others need things from us. Somehow, both the buyer and seller find their own equilibrium point.

市场为买卖双方提供了必要的信息,以便为日常市场交易做出重要决策。这是一个普遍的规则,我们需要别人的东西,别人需要我们的东西。不知何故,买卖双方都找到了自己的平衡点。

Consequences if Apple Inc. fails to introduce Innovation 如果苹果公司未能引入创新的后果

Objectives are the strategic goals of an entity. Conversion of goals into measurable targets is possible through a cataract process that flows from Company’s objectives, to planned business unit objectives, to operate plans for execution of a successful business. To survive in today’s competitive business era, organizations have to understand the factors that cause the entities to achieve their objectives efficiently and effectively.

目标是一个实体的战略目标。通过从公司目标到计划的业务部门目标,再到执行成功业务的运营计划的白内障过程,可以将目标转化为可衡量的目标。为了在当今竞争激烈的商业时代生存,组织必须了解促使实体高效、有效地实现其目标的因素。

A goal-management solution ensures that employee goals and objectives should corroborate with the vision, mission and strategic goals of the entire entity. Goal-management provides company with a technique to effectively and efficiently communicate entity’s goals and corporate objectives to each individual employed in the entire organization. Information Technology affects corporate challenges and creates opportunities and issues that management of an organization need to address in many aspects of their business to execute it in effective and efficient manner.

目标管理解决方案确保员工的目标和目的与整个实体的愿景、使命和战略目标相一致。目标管理为公司提供了一种技术,可以有效地将实体的目标和公司目标传达给整个组织中的每个员工。信息技术会影响公司的挑战,并创造机会和问题,组织的管理层需要在其业务的许多方面解决这些问题,以便以有效和高效的方式执行业务。

Instant changes in information technology have created a market, and a society, where information plays vital role for strong competition among competitors. For Apple Inc. its patent may be its software technology patents that are used as intangible assets. For most businesses, its information database is the most valuable and priceless commodities it owns.

信息技术的即时变化创造了一个市场和社会,在这个市场和社会中,信息在竞争对手之间的激烈竞争中发挥着至关重要的作用。对于苹果公司来说,它的专利可能是作为无形资产使用的软件技术专利。对于大多数企业来说,其信息数据库是其拥有的最有价值、最无价的商品。

It is mandatory for an organization to introduce change in its environment according to the market situation. In the same scenario, if Apple Inc. fails to meet changes of innovation and marketing, it may not only have worst impact on the economy of Apple Inc. but the going concern also affects. If Apple Inc. fails to achieve the innovation requirements in its products then it will have nothing to work towards. Following issues may arise if Apple Inc fails to meet marketing requirements and innovation in technology items:

本篇留学生论文提出组织必须根据市场情况对其环境进行变革。在同样的情况下,如果苹果公司不能适应创新和营销的变化,它不仅可能对公司的经济产生最坏的影响,而且持续的担忧也会影响。如果苹果公司不能在其产品中达到创新要求,那么它将没有什么可努力的。如果苹果公司未能满足营销要求和技术项目创新,可能会出现以下问题:

Entity shall not be able to survive in market due to strong competitors 由于强大的竞争对手,实体将无法在市场上生存

Low profits due to reduced revenues 收入减少导致利润低

Once a customer is diverted to other entity, it is difficult to bring him again 一旦客户被转移到其他实体,就很难再把他带回来

Chances of economic growth will become low 经济增长的机会将变低

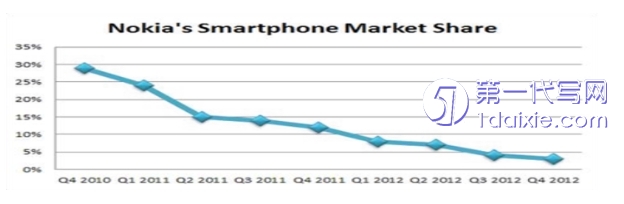

Here is the practical example of Nokia. What happened to Nokia, Reason is: Apple and Android ruined it. But the reasons for that failure are a bit more mysterious. Historically, after all, Nokia had been a surprisingly adaptive company; but shifting to new era create problem for its survival.

以下是诺基亚的实用示例。诺基亚的遭遇,原因是:苹果和安卓毁了它。但失败的原因有点神秘。毕竟,从历史上看,诺基亚是一家适应性极强的公司;但向新时代的转变给其生存带来了问题。

Some of the reasons are given below by the suitable research about their failure:以下通过对其失败的适当研究给出了一些原因

“They lost contact with their customers.” True, — and interesting to notice that this is the same Nokia company that in the early 2000s was applause to its customer responses.

“They failed to introduce the necessary technology requirements.” This might be the significant issue.

“They didn’t recognize that competition basis was shifting from the hardware to the ecosystem.” Not really true — the “ecosystem” battle was initiated in the early 2000s, with Nokia joining forces with Motorola, and Ericsson to create Symbian as a technological platform that kept the Microsoft at bay.

Bibliography 参考文献

PEP, CPB guru 2011, The importance of pricing power:

Morningstar 2011, Pricing strong for Philip Morris in Q3, but volumes also encouraging

W.W. | HOUSTON 2013, Market forces and appeals to fairness, New York times.

Biz Arena,In Focus 2011, Role of Markets and Governments in managing the growth in Emerging/Developing Economies.

Paul J. Bolster, S. G. Badrinath 1996, The role of market forces in EPA enforcement activity, Journal of Regulatory Economics, Volume 10,Issue 2,pp 165-181.

Kondratenko, Anatoly, 2013 Probability Economics: Market Force in The Price Space.

“他们失去了与客户的联系。”没错,有趣的是,这家诺基亚公司在21世纪初对客户的反应报以掌声。

“他们没有引入必要的技术要求。”这可能是一个重大问题。

“他们没有意识到竞争基础正在从硬件转向生态系统。”事实并非如此——“生态系统”之战始于21世纪初,诺基亚与摩托罗拉和爱立信联手创建了塞班,作为一个技术平台,将微软拒之门外。

本站提供各国各专业留学生paper格式范文,留学生论文代写以及留学生论文写作指导,如有需要可咨询本平台。