Business Essay代写范文-外商直接投资与区域发展。本文是一篇本站提供的essay代写范文,主要内容是讲述在过去的几十年里,人们一直在争论外国直接投资和吸引更多外国直接投资的政策是否有助于一个地区的发展。第二次世界大战结束后筹集的外国直接投资,其目的是控制海外生产和服务业务。每个国家在投资发展道路上都占有一席之地,这是由国家的内向和外向投资流决定的,道路的每个阶段都有不同的战略和框架。本篇essay指出发展中国家新兴的充满活力的市场的出现、低成本的劳动力和宽松的工作权利立法是跨国企业从事外国直接投资的最初动机。尽管这些动机刺激了外国直接投资的兴起,但其他原因也起到了作用,例如寻求专门知识和技术或创造资产。1970年后,发展中国家在发达经济体的压力下采用了新自由主义方法,这使得国家干预发展进程和向外国直接投资开放市场的权力降低,即使国家在这一进程中有很大的利害关系。Essay同时指出人们运用了许多理论来理解人类发展超出经济因素的范围。预期寿命和教育等社会指标以及环境指标都被加入了等式,尽管世界银行等许多新自由主义机构坚持主要从经济角度看待发展。为了理解和衡量经济和社会发展,联合国开发计划署综合了人类发展指数,将基本的经济和社会指标包括在内。为了衡量环境发展,耶鲁大学与多个机构合作制定了环境绩效指数,将许多环境指标混合为一个指标。这两个指标是本文发展的主要衡量标准。下面就一起来看一下这篇Business Essay代写范文的全部内容。

Over the past decades, it has been argued whether foreign direct investment and policies that attract more of it, contribute towards the development of a region. Foreign direct investment raised after the end of the Second World War and its aim was the control of overseas production and service operations. Every country occupies a place in the investment development path, which is determined by the nation’s flows of inward and outward investment, with different strategies and different frames for every stage of the path. The emergence of new dynamic markets in the developing world, low cost labor and loose legislation of working rights was the initial motive for multinational enterprises to engage in foreign direct investment. Though these motives stimulated the rise of foreign direct investment, other reasons helped too, such as the seek for know-how and technology or the creation of assets. After 1970, and the adoption of neoliberal approaches from developing nations under the pressures of developed economies, rendered the state less powerful to intervene with the process of development and open their markets to foreign direct investment, even if the state has a high stake in the process. Many theories have been deployed to understand the extend of human development beyond the economic factors. Social indicators such as life expectancy and education were added into the equation as well as environmental indicators, though many neoliberal institutions such as the World Bank insist on perceiving development mainly in economic terms. To understand and measure economic and social development the United Nation Development Program synthesized the Human Development Index to include basic economic and social indicators. For measuring environmental development, the university of Yale in collaboration with various institutions developed the environmental performance index, a mix of many environmental indicators into one. These two indicators are the main measurements of development in this essay.

Dicken’s definition about direct investment is that “direct investment is an investment by one firm in another, with the intention of gaining a degree of control over the firm’s operations. Foreign direct investment is simply direct investment across national boundaries, that is, when a firm from one country buys a controlling investment in a firm in another country, or where a firm sets up a branch or subsidiary in another country”. Direct investment is different from portfolio investment, which is investment in firms without the intention of gaining control over operations but only financial reasons. Foreign direct investment can indicate and measure transnational corporate activity, but it doesn’t capture the full range of corporate operations, due to the variety of ways that transnational corporations can organize their production chains, through joint ventures or alliances. (Dickens, 2007)

本篇essay引用了Dicken对直接投资的定义是“直接投资是一家公司对另一家公司的投资,目的是获得对公司运营的一定程度的控制。外国直接投资只是跨越国界的直接投资,即一个国家的公司购买对另一个国家公司的控制性投资,或一家公司在另一国家设立分支机构或子公司”。直接投资不同于投资组合,后者是对公司的投资,目的不是控制运营,而是出于财务原因。外国直接投资可以指示和衡量跨国公司的活动,但由于跨国公司通过合资企业或联盟组织生产链的方式多种多样,它并不能涵盖公司的全部业务。

Based on the investment development path, states can experience five stages of development of investments, and are categorized based on the tendencies these states have on being an inward or outward investor. This tendency is defined by the competitive advantages domestic firms have over foreign (the C advantages), the advantages gained by the resources and capabilities a country possess (the D advantages), and the advantages gained by the joint exploitation with foreign firms of the resources and capabilities both corporations possess (their E advantages). At the first stage the D advantages of a country are perceived as not existent, except those coming from natural resources. At this stage, outward investment is minimal, and foreign firms prefer to trade and not invest on these economies, because there are no C advantages of domestic firms. Discouragement for investment might be insufficiency in transportation systems or communication or more importantly uneducated, untrained or unmotivated workforce. In stage 2, states experience a rise of inward investment and outward investment stays at minimum levels. The growth of domestic markets might be the incentive for foreign firms to invest in production. Domestic firms must possess some desirable D advantages in order for foreign firms to invest. The D advantages also raise on this stage. Outward investment, if there is any, is for the purpose of market seeking or improving capabilities in developed countries. In stage 3, states experience a decrease in the growth rate of inward investment and a raise in the growth rate of outward investment. Domestic firms start to obtain their own C advantages and compete with foreign firms at the same industries. Government intervention at this stage is less significant. Government policies trying to attract foreign direct investment will target industries whose firm’s C advantages are weaker in comparison with foreign firms but D advantages are stronger. At stage 4, a country’s outward investment stock is greater or even with the stock owned by foreign firms. Domestic firms not only compete with foreign firms in domestic market but are capable of penetrating foreign markets as well. As domestic firm try to maintain their competitiveness by subcontracting operation to lower stage locations, outward investment continues to raise. Inward direct investment at this stage derives from other stage 4 or 5 countries seeking asset creation or by lower stage countries seeking to improve their own capabilities. At the last stage of the investment development path, the net of investment first fluctuates and then comes to a state of equilibrium., though both outward and inward investment tends to increase. At stage 5, most corporate cross border transactions come at the form of intra-trade, the C advantages of corporations depend on the firm’s ability to create assets and most inward investment comes in the form of knowledge seeking from lower stage countries or as a rationalized investment from stage 4 or 5 countries. One more characteristic of this stage is that multinational corporations lose their national identity and do not act towards national interest as they operate on a global scale. (Dunning J., Narula R., 1996).

根据投资发展路径,各州可以经历五个投资发展阶段,并根据这些州作为内向或外向投资者的倾向进行分类。这种趋势是由国内企业相对于外国企业的竞争优势(C优势)、一个国家拥有的资源和能力所获得的优势(D优势)以及与外国企业共同开发两家公司所拥有的资源与能力所取得的优势(E优势)来定义的。在第一阶段,一个国家的D优势被认为是不存在的,除了那些来自自然资源的优势。现阶段,对外投资很少,外国公司更喜欢在这些经济体进行贸易,而不是投资,因为国内公司没有C优势。阻碍投资的可能是交通系统或通信不足,更重要的是未受过教育、未受过培训或没有动力的劳动力。在第二阶段,各州的内向投资有所增加,外向投资保持在最低水平。国内市场的增长可能会激励外国公司投资生产。为了让外国公司投资,国内公司必须拥有一些理想的D优势。D的优势也在这个舞台上出现。对外投资,如果有的话,是为了寻求市场或提高发达国家的能力。在第三阶段,各州的内向投资增长率下降,外向投资增长率上升。国内企业开始获得自己的C优势,并在同一行业与外国企业竞争。现阶段的政府干预不那么重要。政府试图吸引外国直接投资的政策将针对那些公司的C优势与外国公司相比较弱但D优势较强的行业。在第四阶段,一个国家的对外投资存量更大,甚至与外国公司拥有的存量持平。国内企业不仅在国内市场上与外国企业竞争,而且有能力打入国外市场。随着国内企业试图通过将业务分包到较低阶段的地点来保持竞争力,对外投资持续增加。这一阶段的内向直接投资来自寻求创造资产的其他第4或第5阶段国家,或来自寻求提高自身能力的较低阶段国家。在投资发展路径的最后阶段,投资净额首先波动,然后达到均衡状态。,尽管对外投资和内向投资都有增加的趋势。在第五阶段,大多数企业跨境交易都是以内部贸易的形式进行的,企业的C优势取决于企业创造资产的能力,大多数内向投资都是以从较低阶段国家寻求知识的形式进行,或者是作为第四或第五阶段国家的合理投资。这一阶段的另一个特点是,跨国公司在全球范围内经营时,失去了国家身份,不为国家利益行事。

Motives for foreign direct investment are market exploitation, cost reduction or strategic asset acquirement. New markets attract foreign direct investment, with several benefits for setting up close to a new market such as, closer interaction with suppliers and customers or the image of the firm as quasi-local. Policies of contagious markets towards foreign investment might be crucial, as the firm uses those markets to export products. Strategic motives constitute an important motive for foreign direct investment, as multinational enterprises tend to target oligopolistic industries that compete on global or regional scale. Therefore, the decision of the investment is not made autonomous and takes into consideration the behavior, acts and expectations of the firm’s competitors. Multinationals seek to move earlier in recent opened markets for various reasons, such as to establish a first mover advantage, manage to acquire certain sites or build up a brand name. Low cost is one more incentive for foreign direct investment and especially low labor cost. Multinational enterprises move operations from region to region to exploit low labor cost relative to other costs, such as transportation, energy or raw materials. Some other aspect that affect inward investment are the political stability, the policy environment and the infrastructure. Corporations will be reluctant to invest in a political environment that is not stable. Policies that favor foreign direct investment and constant reform is a major attraction for transnationals. Lastly, if the infrastructure is unorganized and the rule of law barely existent, will discourage firms to invest, due to the lack of protection towards their property and income. (Estrin S., Hughes K., et.al, 1997).

本篇essay提出外国直接投资的动机是开拓市场、降低成本或战略性资产获取。新市场吸引外国直接投资,在新市场附近建立有几个好处,例如与供应商和客户的互动更密切,或者公司的准本地形象。具有传染性的市场对外国投资的政策可能至关重要,因为该公司利用这些市场出口产品。战略动机是外国直接投资的重要动机,因为跨国企业往往以在全球或区域范围内竞争的寡头垄断行业为目标。因此,投资决策不是自主的,而是考虑了公司竞争对手的行为、行为和期望。跨国公司出于各种原因,如建立先发优势、设法收购某些网站或建立品牌等,寻求在最近开放的市场中更早行动。低成本是外国直接投资的又一个激励因素,尤其是低劳动力成本。跨国企业将业务从一个地区转移到另一个地区,以利用相对于运输、能源或原材料等其他成本较低的劳动力成本。影响外来投资的其他方面是政治稳定、政策环境和基础设施。企业将不愿在不稳定的政治环境中投资。有利于外国直接投资和不断改革的政策是跨国公司的主要吸引力。最后,如果基础设施没有组织,法治几乎不存在,将阻碍企业投资,因为它们的财产和收入缺乏保护。

Foreign direct investment and transnational enterprises can rise from the lack of local and near market’s intangible assets, such as knowledge, managerial and marketing skills or technology. If a firm has some of these assets in its possession and wants to deploy them in global production, three ways to do it are subsidiary production, joint ventures and licensing. Subsidiary production and joint ventures include equity participation while licensing suggests arm’s length transactions for the acquisition of technology or skills. All three forms of investing offer advantages and disadvantages. For example, subsidiary production overseas might reduce costs from operations. On the other hand, set up cost that are related to subsidiary production might be discouraging. Determinants for the selection between joint ventures, licensing and subsidiary production are the transaction costs involved which are shaped by each host country’s policies, and are defined from the degree of how much of the assets traded are proprietary, the level of complexity and tactical importance of the transaction and the frequency of these types of transactions. The intangible assets that multinational enterprises possess are the ones that give multinationals their superior advantage from local firms and based on the nature of those assets the choice of operations vary. For example, a firm in technology industry would prefer control over an investment to avoid leaks of knowledge and information. (Blomstrom M, Kokko A., et.al, 2000).

外国直接投资和跨国企业可能因缺乏知识、管理和营销技能或技术等当地和近市场无形资产而崛起。如果一家公司拥有其中一些资产,并想将其部署到全球生产中,有三种方法可以实现:子公司生产、合资企业和许可证。子公司生产和合资企业包括股权参与,而许可证则意味着收购技术或技能的公平交易。这三种投资形式都有优缺点。例如,海外子公司生产可能会降低运营成本。另一方面,与子公司生产相关的设立成本可能会令人沮丧。在合资企业、许可证和子公司生产之间进行选择的决定因素是所涉及的交易成本,这些成本由每个东道国的政策决定,并根据交易资产的所有权程度、交易的复杂性和战术重要性以及这些类型交易的频率来定义。跨国企业拥有的无形资产使跨国公司比当地公司具有更大的优势,根据这些资产的性质,经营方式的选择各不相同。例如,科技行业的公司更喜欢控制投资,以避免知识和信息的泄露。

The approach of international investment for international production coincided with the reform in many developing nations regarding their industrialization policies, answering to pressures from developed economies and international institutions. The raise of neoliberal ideologies compelled many developing nations to adopt policies that supported free markets and attracted foreign investment, policies such as reduced tariffs, infrastructure reform or reduced taxation. These types of policies can be interpreted as ‘a race to the bottom’, because they lead up in nations undermine each other to attract foreign investment. Such actions might result in lower wages, environmental negligence or insufficient contribution towards the tax base. In the recent decades, most countries have adopted policies favoring foreign investment, even countries with communist or authoritative regimes, with few exceptions. This implies that national economies are connected with multinational enterprises, with firms possessing significant power in the relationship. In many cases, corporate power undermines the power possessed by the nation states. (Williams G, Meth P., 2014).

国际投资促进国际生产的做法恰逢许多发展中国家对其工业化政策进行改革,以应对发达经济体和国际机构的压力。新自由主义意识形态的兴起迫使许多发展中国家采取支持自由市场和吸引外国投资的政策,如降低关税、基础设施改革或减税。这些类型的政策可以被解释为“向底层的竞争”,因为它们导致国家相互破坏以吸引外国投资。这种行为可能导致工资下降、环境疏忽或对税基的贡献不足。近几十年来,大多数国家都采取了有利于外国投资的政策,即使是拥有共产主义或权威政权的国家,也很少有例外。这意味着国家经济与跨国企业有联系,企业在这种关系中拥有重要的权力。在许多情况下,公司权力削弱了民族国家所拥有的权力。

As transnational corporations came to dominate and shift the global economy through global investment and economies of scale, national governments clearly have an interest about these economic flows, either negative or positive. For a national government, there are two kinds of this investment. Domestic firms investing outwards or foreign firms investing inwards. Policies that are set by national governments, usually refer on inward investment, though some policies restricting outward investment might exist, such as the demand for government authorization before an outward investment completes. Developed countries tend to be more open towards inward foreign investment than developing, though that’s not always the case. Examples like France’s strict policies, or Singapore’s liberal ones. However, the tendency for favorable foreign direct investment policies is growing. (Dickens, 2007).

随着跨国公司通过全球投资和规模经济主导和改变全球经济,各国政府显然对这些经济流动感兴趣,无论是负面的还是正面的。对于一个国家政府来说,这种投资有两种。国内公司向外投资或外国公司向内投资。国家政府制定的政策通常涉及内向投资,尽管可能存在一些限制外向投资的政策,例如在外向投资完成之前需要政府授权。发达国家对外来外国投资往往比发展中国家更开放,尽管情况并非总是如此。比如法国的严格政策,或者新加坡的自由政策。然而,有利的外国直接投资政策的趋势正在增长。

In the past century, scientist from different fields, such as economic, social or environmental, evolved theories aiming to understand and shape development. The classical approach that most nations applied after the end of the Second World War, was the economic growth theory, conceptualized by economist John Keynes. This approach emphasized the crucial role of national governments in shaping economic growth, by investing in new infrastructure projects, such as roads or damns, even if the state had to borrow money. The projects would offer needed jobs to the unemployed population, which in turn would increase the purchasing power of the working class, which in turn would help provide needed cash flows in the market. Though, if the citizens preferred to purchase goods and services from other nations, the wealth generated for their own nation would be at lower levels. (Hopper P., 2012). With the collapse of the Bretton Woods regime, some theorist believed that state intervention was slowing down economic growth, and better rates would have achieved if the market was regulated by itself. These ideas were drawn from the work of Adam Smith. Neoliberals approach was that the reduction of state intervention and letting the market decide on wages and prices, would lead to better economic growth and therefore well-being. They argued that this approach would achieve optimal resource allocation with consequent benefits. (Willis K., 2004). Critical modernist development theorists believe that mankind possesses the necessary intellectual and practical know how to support more people on earth than ever before. Therefore, they hold high, social indicators in indicating development. Critical modernist aim to “extend the benefits from economic growth to a world of people, starting with the poorest while, in the process, transforming social relations of control to democratize all aspects of existence, and rethinking relations with nature to ensure both continued livelihoods and the fecundity of nature”. (Peet R., Hartwick E., 1999).

在过去的一个世纪里,来自经济、社会或环境等不同领域的科学家发展出了旨在理解和塑造发展的理论。第二次世界大战结束后,大多数国家采用的经典方法是经济学家约翰·凯恩斯提出的经济增长理论。这种方法强调了国家政府在塑造经济增长方面的关键作用,通过投资新的基础设施项目,如道路或水坝,即使国家不得不借钱。这些项目将为失业人口提供所需的工作岗位,这反过来又将提高工人阶级的购买力,这反过来将有助于在市场上提供所需现金流。然而,如果公民更喜欢从其他国家购买商品和服务,那么为自己国家创造的财富将处于较低水平。随着布雷顿森林体系的崩溃,一些理论家认为,国家干预正在减缓经济增长,如果市场由自己监管,利率就会提高。这些思想是从亚当·斯密的作品中汲取的。新自由主义者的观点是,减少国家干预,让市场决定工资和价格,将带来更好的经济增长,从而带来福祉。他们认为,这种方法将实现最佳的资源分配,并带来相应的好处。批判现代主义发展理论家认为,人类拥有必要的智力和实践知识,能够比以往任何时候都支持地球上更多的人。因此,它们在显示发展方面具有较高的社会指标。批判现代主义的目标是“将经济增长的好处扩展到一个由人组成的世界,从最贫穷的人开始,同时在这个过程中,转变社会控制关系,使生存的各个方面民主化,并重新思考与自然的关系,以确保持续的生计和自然的繁衍”。

In the Washington Consensus, it was decided the support of neoliberal policies and regulations by a ‘free market’, despite the beliefs that national states were important actors in state development. Despite each nations regimes and ideologies, all nations exercise sovereignty and that provides them with two unique options to influence development. First, though they may get criticized by the international community and international institutions, they can implement policies in other areas that will influence their development. Second, states “are institutions that claim to represent the collective will of their people”. Regardless their regime (democratic, authoritative or communist) no other institution – non-governmental organizations, multinational corporations or international development institutions- can make the same claim at this scale. This power combined with their ability to legislate can make the state an important actor in regional development. (Williams G., Meth P., 2014).

在《华盛顿共识》中,决定通过“自由市场”支持新自由主义政策和法规,尽管人们认为国家是国家发展的重要参与者。尽管每个国家都有政权和意识形态,但所有国家都行使主权,这为它们影响发展提供了两种独特的选择。首先,尽管他们可能会受到国际社会和国际机构的批评,但他们可以在其他领域实施影响其发展的政策。其次,国家“是声称代表其人民集体意愿的机构”。无论其政权(民主、权威或共产主义)如何,任何其他机构——非政府组织、跨国公司或国际发展机构——都无法在这种规模上提出同样的主张。这种权力与他们的立法能力相结合,可以使国家成为区域发展的重要参与者。

The word “region” is multifaceted and its meaning changes based on the context of use. It can be used to describe a small area around someone’s house or a big multistate area as well. As global trade arises, economic researchers are starting to recognize the importance of multinational regions. Economists differentiate between development and growth. Though growth is an important aspect of development it does not capture the entire picture. Investments that provide low wage jobs might increase the overall size of the economy but not the income per capita. Economic development insinuates that the quality of life increases by improving per capita income. However, that alone is not a complete indicator of economic development. There are more factors that shape development, such as education or life expectancy and infant mortality. Focusing on the economic aspect does not help determine local development, because it is a part of a larger frame of community development. (Blair J, 1995). Economic development relates to improving material welfare, mainly for the lower income brackets; the elimination of mass poverty and all the factors leading to that such as illiteracy or disease; configurations of the inputs and outputs of the economy and policies shifting production from the agricultural sector towards industrial activities; provision of employment towards all the working age population not just a privileged minority and a wider range of participant groups in the decision making process of economic or other policies, that shape their welfare. (Kindleberger, 1977). From the economic scope, development takes place when a state who has been static manages an annual increase of their gross national income between 5% and 7%. An alternative indicator is the growth of gross national income per capita to demonstrate the ability of a state to increase their income in relation with their population growth. Development in every society has three fundamental objectives. The first is to increase the access to basic resources, such as food, healthcare and housing and towards a more equal distribution of these resources. Second is the raise of the standard quality of life, not only the basic income levels, which raise only the material well-being, but also education services and human rights, that raise awareness and self-esteem. Third, to broaden the range of social choices accessible to individuals, that helps them unshackle from ignorance and misery. (Stephen, Todaro, 2006).

Essay指出“地区”一词是多方面的,其含义会根据使用情况而变化。它可以用来描述某人房子周围的一个小区域,也可以用来描述一个大的多州区域。随着全球贸易的兴起,经济研究人员开始认识到跨国地区的重要性。经济学家区分发展和增长。尽管增长是发展的一个重要方面,但它并不能反映整个情况。提供低工资工作的投资可能会增加经济的整体规模,但不会增加人均收入。经济发展意味着通过提高人均收入来提高生活质量。然而,这本身并不是经济发展的一个完整指标。影响发展的因素更多,如教育或预期寿命和婴儿死亡率。关注经济方面无助于决定地方发展,因为它是社区发展的一个更大框架的一部分。经济发展涉及改善物质福利,主要是低收入阶层的物质福利;消除大规模贫困和导致贫困的所有因素,如文盲或疾病;经济投入和产出的配置以及将生产从农业部门转向工业活动的政策;为所有劳动年龄人口提供就业机会,而不仅仅是少数特权群体和经济或其他政策决策过程中更广泛的参与群体,这些政策决定了他们的福利。从经济范围来看,当一个国家的国民总收入每年增长5%至7%时,就会发生发展。另一个指标是人均国民总收入的增长,以表明一个国家有能力随着人口增长而增加收入。每个社会的发展都有三个基本目标。首先是增加获得食品、医疗保健和住房等基本资源的机会,并实现这些资源的更平等分配。第二是提高标准生活质量,不仅是提高物质福利的基本收入水平,而且是提高认识和自尊的教育服务和人权。第三,扩大个人的社会选择范围,帮助他们摆脱无知和痛苦。

The Human Development Index is “a composite index measuring average achievement in three basic dimensions of human development-a long and healthy life, knowledge and a decent standard of living” (Jahan S., Jespersen E., 2015). Its aim is to measure development and allow cross-border comparisons. The United Nations Developing Programme conceives human development as the creation of an environment that helps people reach their potential, experience a productive and creative life in accordance to their interests and needs and widen the range of choices that help people lead lives that they perceive as valuable. Human development index reflects this, by measuring life expectancy, education and gross national income per capita. Human development index has been developed by UNDP and is published in the Human Development report since 1990. Upon its introduction, HDI gained increased attention, due to the fact that measuring gross domestic product and gross national income was inadequate. It is considered as an upgrade of the existing indicators of private purchasing power, to include quality of life and welfare into the equation. The Human Development Index is used broadly by governments to evaluate and design economic and development policies. (Hou J., Walsh P., et.al, 2014).

人类发展指数是“衡量人类发展三个基本方面——健康长寿、知识和体面生活水平——平均成就的综合指数”。其目的是衡量发展情况,并允许进行跨境比较。联合国开发计划署将人类发展视为创造一种环境,帮助人们发挥潜力,根据自己的兴趣和需求体验富有成效和创造性的生活,并扩大选择范围,帮助人们过上他们认为有价值的生活。人类发展指数通过衡量预期寿命、教育和人均国民总收入反映了这一点。人类发展指数由开发计划署制定,本篇essay提出自1990年以来发表在《人类发展报告》中。人类发展指数一经推出,就受到越来越多的关注,因为衡量国内生产总值和国民总收入是不够的。这被认为是对现有私人购买力指标的升级,将生活质量和福利纳入等式。各国政府广泛使用人类发展指数来评估和设计经济和发展政策。

A truly developed nation seeking to maintain development, should decide on development policies not only based on human development indicators but also with concern of the environment. The Organization of Economic Cooperation and Development does not recognize a particular set of indicators rather than the existence of many. There is a core set of primary indicators to evaluate environmental performance such as gas emissions and greenhouse effects, water resources and availability, biodiversity etc. Specific sector indicators also help to form policies in certain industries such as agriculture or transportation. Lastly, there are environmental indicators that integrate environmental apprehensions into economic policies and shape the management of national resources. (OECD, 1998). The Environmental Performance Index is an indicator developed by Yale University and many various institutions, that evaluates a nation’s environmental performance. it consists of two categories, the protection of human health and the protection of the ecosystem. EPI examines nine core categories, such as greenhouse gas emissions or water resources, with more than twenty indicators, and measures the performance of states in reaching global environmental goals. (Hsu A., et.al, 2016).

一个寻求维持发展的真正发达国家,不仅应该根据人类发展指标,而且应该考虑到环境问题来决定发展政策。经济合作与发展组织不承认一套特定的指标,而承认存在许多指标。有一套核心的主要指标来评估环境绩效,如气体排放和温室效应、水资源和可用性、生物多样性等。具体的部门指标也有助于制定农业或交通运输等特定行业的政策。最后,还有一些环境指标将对环境的担忧纳入经济政策,并影响国家资源的管理。环境绩效指数是耶鲁大学和许多不同机构制定的一项指标,用于评估一个国家的环境绩效。它包括两类,保护人类健康和保护生态系统。EPI用20多项指标研究了温室气体排放或水资源等九个核心类别,并衡量各国在实现全球环境目标方面的表现。

The purpose of this essay is to examine if inward foreign direct investment is beneficial towards the development -economic, social or environmental- of different regions. For this research, data from 172 countries were gathered. More specifically, foreign direct investment inward and outward flows were collected from the United Nations Conference of Trade and Development and are measured in millions of dollars, human development index scores were extracted from the United Nations Developing Programme and the environmental performance index scores were taken from the official environmental performance index site powered by Yale university. For analysis of the data, regression analysis will be used, as well as Pearson’s correlation.

本篇essay研究的目的是考察外来直接投资是否有利于不同地区的经济、社会或环境发展。这项研究收集了172个国家的数据。更具体地说,流入和流出的外国直接投资是从联合国贸易和发展会议收集的,以数百万美元计量,人类发展指数得分取自联合国开发计划署,环境绩效指数得分取自耶鲁大学提供支持的官方环境绩效指数网站。对于数据的分析,将使用回归分析以及皮尔逊相关性。

It is worth noting some countries that were excluded from the model, due to insufficient data but amaze with their foreign direct investment inward and outward flows. Most notable is Hong Kong with inward flows reaching 114,054 million of dollars and outward flows reaching 125,109 million of dollars. Other notable countries are Cayman Island with inflows at 23,731 and outflows at 8,737 million of dollars, Macao with inward flows of 3,294 and outward flows of 681 million of dollars, Taiwan with inward flows of 2,839 and outward flows of 12,711 million of dollars and New Caledonia with inward flows of 1,781 and outward flaws of 62 million of dollars. Other nations that were excluded are Capo Verde, Cook Islands, Cuba, Curacao, French Polynesia, Gambia, Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Sint Maarten and Somalia.

Saint 值得注意的是,一些国家由于数据不足而被排除在该模型之外,但其外国直接投资流入和流出却令人惊讶。最值得注意的是香港,流入资金达11405.4亿美元,流出资金达1251.09亿美元。其他值得注意的国家包括开曼岛,流入23731美元,流出8.737亿美元;澳门,流入3294美元,流出6.81亿美元;台湾,流入2839美元,流出12.711亿美元;新喀里多尼亚,流入1781美元,流出6200万美元。其他被排除在外的国家有佛得角、库克群岛、古巴、库拉索岛、法属波利尼西亚、冈比亚、圣基茨和尼维斯、圣卢西亚、圣文森特和格林纳丁斯、圣马丁岛和索马里。

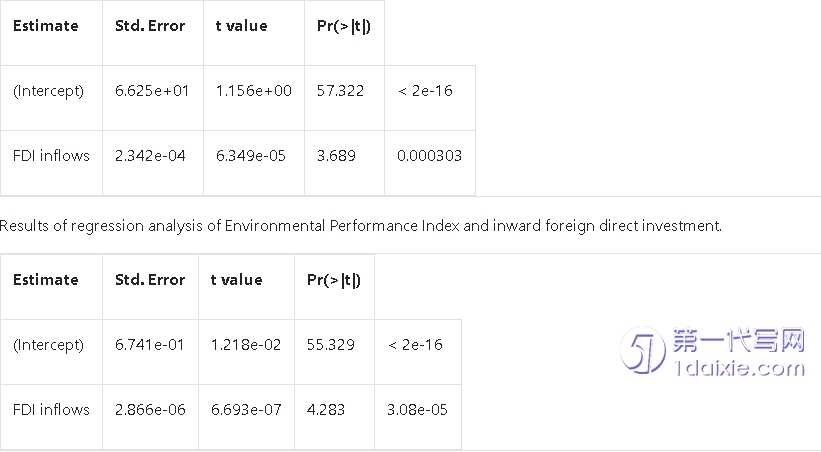

Results of regression analysis of Human Development index and inward Foreign Direct Investment 人类发展指数与外商直接投资的回归分析结果

Multiple R-squared: 0.09738, Adjusted R-squared: 0.09207

Pearson analysis results: correlation degree at 0.3120621

Multiple R-squared: 0.07412, Adjusted R-squared: 0.06867

Pearson analysis results: correlation degree at 0.2722476

In the case of HDI, the results show that for every million invested in a nation their human development index raises for 2.866e-6 = 0,000002866 points, with significance levels at 3.08e-5 = 0.0000308 < 0.05 indicating that the results are real, R-squared at 9.7% and correlation degree at 0.3 which shows low correlation.

就人类发展指数而言,结果显示,一个国家每投资100万美元,其人类发展指数就会上升2.866e-6=0.0000002866点,3.08e-5=0.00000308<0.05的显著性水平表明结果是真实的,R平方为9.7%,相关度为0.3,表明相关性较低。

In the case of EPI, the results show that for every million invested in a nation their environmental performance index raises for 2.342e-4 = 0.002342 points. With significance levels at 0.000303 < 0.05 indicating that the results are real, R-squared at 7.4% and correlation degree at 0.27 which shows low correlation

在EPI的情况下,结果显示,一个国家每投资100万美元,其环境绩效指数就会上升2.342e-4=0.002342点。0.000303<0.05的显著性水平表明结果是真实的,R平方为7.4%,相关度为0.27,表明相关性较低

The common notion dictates that foreign direct investment is a needed tool towards development, without taking into account what the countries have to give up to attract such investments. Nowadays, multinational enterprises engage daily in foreign direct investment, trying to take advantage of the benefits that it offers, in regard with the position on the investment development path of the host country. States are pursuing the attraction of such investments, with little regard towards the dignity of their own citizens, their wages and their welfare, pressured by international development institutions and by governments of developed economies that have interests embedded in the host nation’s economies. Theorist have tried to find a pattern for the ideal process of development and the states position and role in it, with many advocating minimal intervention and others perceiving the government as an important actor. After decades conceptualizing development as an economic phenomenon alone, scientists and institutions have agreed that for a thorough measurement and understanding of development, social and environmental performances should be considered too, leading to the creation of complicated indexes that include them as well. Development will always be a controversial subject, with different opinions being dominant each chronological period, but the understanding that including many aspects in the concept – economic, social, environmental, freedom or equality related- enhances the outcome, shows that mankind is pacing on the right path.

REFERENCES 参考文献

Blair J., “Local Economic Development, Analysis and Practice”, 1995

Blomstrom M., Kokko A., Zejan M., “Foreign Direct Investment, Firm and host country strategies”, 2000

Dickens P., “Global shift mapping the changing contours of global economy”, 2007

Dunning j., Narula R., “FDI and Governments”, 1996

Estrin S., Hughes K., Todd S., “Foreign Direct Investment in Central and Eastern Europe”, 1997

Hopper P., “Understanding Development”, 2012

Hou J., Walsh P., Zhang J., “The dynamics of Human Development Index”, the social science journal, 2014,

Jahan S., Jespersen E., “Human Development Report”, 2015

Kindleberger Herrick, “Economic development”, 3rd edition, 1977

OECD, “Towards sustainable development, Environmental indicators”, 1998

Peet R., Hartwick E., “Theories of Development”, 1999

Todaro M., Smith S., “economic development”, 9th edition, 2006

Williams G., Meth P., Willis K., “Geographies of developing Areas”,2nd edition, 2014

Willis K., “theories and practice of development”, 2004

Yale University, Yale-NUS College, National University of Singapore, Center for International Earth Science Information Network, Columbia University, Yale Center for Environmental Law & Policy, Principal Investigator and Director Professor Angel Hsu, “Global Metrics for the Environment”, 2016

本篇essay提出共同的概念表明,外国直接投资是促进发展的必要工具,而没有考虑到各国为了吸引这种投资必须放弃什么。如今,跨国企业每天都在从事外国直接投资,试图利用其在东道国投资发展道路上的地位所带来的好处。各国在国际发展机构和与东道国经济有利害关系的发达经济体政府的压力下,不顾本国公民的尊严、工资和福利,努力吸引此类投资。理论家们试图为理想的发展过程以及国家在其中的地位和作用找到一种模式,许多人主张尽量减少干预,另一些人则认为政府是一个重要的行动者。本篇essay总结了几十年来,科学家和机构仅将发展概念化为一种经济现象,他们一致认为,为了彻底衡量和理解发展,还应该考虑社会和环境表现,从而创建包括这些表现的复杂指数。发展永远是一个有争议的主题,每个时间段都有不同的观点,但将经济、社会、环境、自由或平等等许多方面纳入概念会增强结果,这表明人类正在正确的道路上前进。本站提供各国各专业留学生essay范文,essay代写以及essay写作辅导,如有需要可咨询本平台。