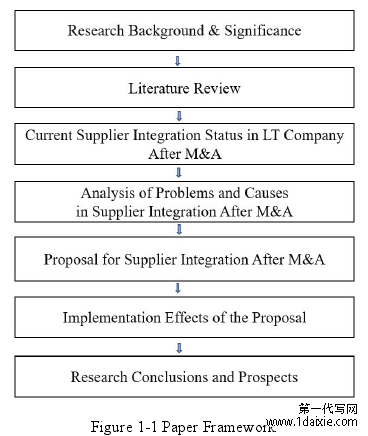

1 Introduction

1.1 Research Background

With the economic globalization and the vigorous development of emergingtechnologies, the world economy is further integrated deeply, and the upsurge ofmutual investment and M&A among enterprises continues unabated. M&A, as one ofthe most important approaches to achieve rapid expansion of the enterprise scale andthe development of new markets,has been widely adopted by enterprises throughoutthe world. Through M&A, enterprises form new and strong strategic alliances andparticipate in global competition in order to enhance the overall competitiveadvantage and achieve strategic goals. According to the "Annual Report of the GlobalM&A Market 2018" by the international agency Bain & Company, global M&A in2018 set a record of nearly US $ 3.47 trillion, close to the highest point in history.

1.1 Research Background

With the economic globalization and the vigorous development of emergingtechnologies, the world economy is further integrated deeply, and the upsurge ofmutual investment and M&A among enterprises continues unabated. M&A, as one ofthe most important approaches to achieve rapid expansion of the enterprise scale andthe development of new markets,has been widely adopted by enterprises throughoutthe world. Through M&A, enterprises form new and strong strategic alliances andparticipate in global competition in order to enhance the overall competitiveadvantage and achieve strategic goals. According to the "Annual Report of the GlobalM&A Market 2018" by the international agency Bain & Company, global M&A in2018 set a record of nearly US $ 3.47 trillion, close to the highest point in history.

M&A Market 2018" by the international agency Bain & Company, global M&A in2018 set a record of nearly US $ 3.47 trillion, close to the highest point in history.M&A have changed the company's operating boundaries and environment, from themoment of signing the M&A agreement, the two parties have stepped into anotherstage:M&A integration. A large number of successful and failed M&A cases haveshown that integrated management after M&A is crucial to the realization of M&Agoals, and it is directly correlated to the success or failure of M&A. Many companieshave just focused on M&A negotiations and transactions, but have not paid enoughattention to the post-merger reorganization and integration that determine the successor failure of M&A on a larger scale, resulting in weak post-merger control and wastedresources. As Green (1993) said: " Yet, there is a big difference between making anacquisition and making it work. Unfortunately, too many businesses view anacquisition as an end in itself, rather than as a means to an end." The acquiringcompany and the target company originally run their own independent managementsystems completely, in the process of the post-merger integration and thereorganization of resources between two companies, various types of conflicts willoccur inevitably, which will consequently affect all aspects of the company operations.Therefore, how to integrate after M&A and how to produce the best economicbenefits are challenges that enterprises will need to face and resolve.

.........................

.........................

1.2 Research Significance

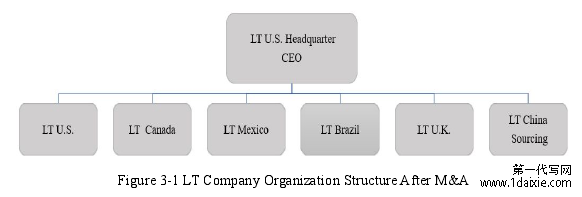

The research object in this paper is LT Company, a multinational trading companyfocusing on kitchenware, tableware and homeware products designing, branding, andglobal marketing. Through multiple M&A, LT Company has acquired manywell-known brands in the industry and rapidly expanded its product line, as well asopening up the international market, so that the company has grown into one of theleading companies in kitchenware and tableware industry in American market.On the one hand, LT Company has obtained a large number of resources of brands,markets and suppliers,and the advantages of large-scale operation through M&A, buton the other hand, the company has also faced a lot of problems like how to maximizethe benefits through the reorganization and integration after M&A. LT Company is atrading firm with all manufacturing outsourced to suppliers, from the beginning ofdrawings to the completion of packaged goods, the outsourced suppliers are in chargeof the entire production and the logistics before shipments, a benign operation of thesupplier system is not only the key to ensure the stability of product quality, punctualdelivery and cost advantage, but also the core part of supply chain management in LTCompany. Therefore, how to integrate suppliers after M&A, and how to optimize theoperation of the entire supply chain have been a crucial part in the process ofpost-merger integration in LT Company. With the continuous M&A and restructuringin LT Company, a series of problems have been raised increasingly in the process ofsuppliers integration, like the number of suppliers has surged, the response to thediversified market has been sluggish, the concept of integration has lagged behind,resulting in short-term behaviors more than long-term cooperation, complex internalprocurement organizations and diverse processes, and the poor sharing of informationbetween procurement departments have led to the difficulty in coordination. Theseproblems have severely affected LT Company to obtain the integrated advantage ofsupplier resources and improve the efficiency of supply chain operations, which isextremely detrimental to the achievement of its long-term development goals.

.............................

2 Literature Review

2.1 Review on M&A Theory

2.1.1 Concept of M&A

Mergers and acquisitions (M&A) are a general term used to describe the consolidationof companies or assets through various types of financial transactions, including twoaspects: mergers and acquisitions (Gan & Liu, 2002). Mergers refer to the propertyrights transaction of two or more independent enterprises and form a single new entityunder certain conditions. In short, mergers are the combination of two companies toform one. The rights and obligations of the original enterprises are assumed by thenewly formed enterprise. Acquisitions refer to the act that a company buys the assetsor equity of another company through certain financial ways such as cash, stocks orbonds to obtain control of the target company, it is one company taken over byanother. In a simple acquisition, the acquiring company obtains the majority stake inthe target company, which does not change its name or alter its legal structure. But ina 100% equity acquisition, the target company may lose its legal person status afterpost-merger integration and be completely merged into the acquiring company.In term of management theory and in the business world, the terms "mergers" and"acquisitions" are often used interchangeably and combined to one, collectivelyknown as M&A, although in actuality, they hold slightly different legal meanings, butfrom the perspective of management, mergers or acquisitions have similarmotivations and same transaction object-property rights. In M&A, the party thatobtains control is called acquirer or acquiring company, and the other party is calledthe acquiree or target company.

........................

2.2 The Post-merger Integration

M&A usually go through three phases: identifying the target enterprise, reaching a deal and integrating. After the completion of the first two phases, integration becomescritical and is the phase that takes the longest time and is difficult to control.Integration has the meaning of "adjustment and integration", that is, adjust thestructure, system integration, from disorder to order, from contradiction to unity, sothat the system can maximize the function of the implementation of the establishedstrategic objectives.

Pan (2006) pointed out in her research that acquiring company restructure or integrateresources after acquiring the target company, ranging from small adjustments tohuman resource structure and management methods to large adjustments includingmanagement strategies, business processes, sales networks and governancemechanisms. In the process of M&A integration, there is often a crisis of powerstruggle among top managers, the loss of key employees, the impact of culturaldifferences, and the loss of key resources such as markets, information and technology.Therefore, it is crucial to strengthen the post-merger integration.

Tienari (2000) addressed that successful M&A need to effectively integrate thecompanies involved in M&A. If the integration is weak, not only the synergy effectcannot be achieved, but also the business performance of the enterprise group may bedragged down by the new companies acquired in M&A. Habeck, Kroger and Tram(2000) had conducted survey and research of the failure of various M&A, and pointedout that the main reason for the failure of M&A was the problem of post-mergerintegration. Belcher (1999) and Nail (2000) further put forward that the main reasonfor the failure of cross-border M&A is cultural differences and considered theimplementation of a post-merger cultural integration strategy to be the key to thesuccess of M&A.

...............................

3 CURRENT SUPPLIER INTEGRATION STATUS IN LT COMPANY AFTER M&A....... 18The research object in this paper is LT Company, a multinational trading companyfocusing on kitchenware, tableware and homeware products designing, branding, andglobal marketing. Through multiple M&A, LT Company has acquired manywell-known brands in the industry and rapidly expanded its product line, as well asopening up the international market, so that the company has grown into one of theleading companies in kitchenware and tableware industry in American market.On the one hand, LT Company has obtained a large number of resources of brands,markets and suppliers,and the advantages of large-scale operation through M&A, buton the other hand, the company has also faced a lot of problems like how to maximizethe benefits through the reorganization and integration after M&A. LT Company is atrading firm with all manufacturing outsourced to suppliers, from the beginning ofdrawings to the completion of packaged goods, the outsourced suppliers are in chargeof the entire production and the logistics before shipments, a benign operation of thesupplier system is not only the key to ensure the stability of product quality, punctualdelivery and cost advantage, but also the core part of supply chain management in LTCompany. Therefore, how to integrate suppliers after M&A, and how to optimize theoperation of the entire supply chain have been a crucial part in the process ofpost-merger integration in LT Company. With the continuous M&A and restructuringin LT Company, a series of problems have been raised increasingly in the process ofsuppliers integration, like the number of suppliers has surged, the response to thediversified market has been sluggish, the concept of integration has lagged behind,resulting in short-term behaviors more than long-term cooperation, complex internalprocurement organizations and diverse processes, and the poor sharing of informationbetween procurement departments have led to the difficulty in coordination. Theseproblems have severely affected LT Company to obtain the integrated advantage ofsupplier resources and improve the efficiency of supply chain operations, which isextremely detrimental to the achievement of its long-term development goals.

.............................

2 Literature Review

2.1 Review on M&A Theory

2.1.1 Concept of M&A

Mergers and acquisitions (M&A) are a general term used to describe the consolidationof companies or assets through various types of financial transactions, including twoaspects: mergers and acquisitions (Gan & Liu, 2002). Mergers refer to the propertyrights transaction of two or more independent enterprises and form a single new entityunder certain conditions. In short, mergers are the combination of two companies toform one. The rights and obligations of the original enterprises are assumed by thenewly formed enterprise. Acquisitions refer to the act that a company buys the assetsor equity of another company through certain financial ways such as cash, stocks orbonds to obtain control of the target company, it is one company taken over byanother. In a simple acquisition, the acquiring company obtains the majority stake inthe target company, which does not change its name or alter its legal structure. But ina 100% equity acquisition, the target company may lose its legal person status afterpost-merger integration and be completely merged into the acquiring company.In term of management theory and in the business world, the terms "mergers" and"acquisitions" are often used interchangeably and combined to one, collectivelyknown as M&A, although in actuality, they hold slightly different legal meanings, butfrom the perspective of management, mergers or acquisitions have similarmotivations and same transaction object-property rights. In M&A, the party thatobtains control is called acquirer or acquiring company, and the other party is calledthe acquiree or target company.

........................

2.2 The Post-merger Integration

M&A usually go through three phases: identifying the target enterprise, reaching a deal and integrating. After the completion of the first two phases, integration becomescritical and is the phase that takes the longest time and is difficult to control.Integration has the meaning of "adjustment and integration", that is, adjust thestructure, system integration, from disorder to order, from contradiction to unity, sothat the system can maximize the function of the implementation of the establishedstrategic objectives.

Pan (2006) pointed out in her research that acquiring company restructure or integrateresources after acquiring the target company, ranging from small adjustments tohuman resource structure and management methods to large adjustments includingmanagement strategies, business processes, sales networks and governancemechanisms. In the process of M&A integration, there is often a crisis of powerstruggle among top managers, the loss of key employees, the impact of culturaldifferences, and the loss of key resources such as markets, information and technology.Therefore, it is crucial to strengthen the post-merger integration.

Tienari (2000) addressed that successful M&A need to effectively integrate thecompanies involved in M&A. If the integration is weak, not only the synergy effectcannot be achieved, but also the business performance of the enterprise group may bedragged down by the new companies acquired in M&A. Habeck, Kroger and Tram(2000) had conducted survey and research of the failure of various M&A, and pointedout that the main reason for the failure of M&A was the problem of post-mergerintegration. Belcher (1999) and Nail (2000) further put forward that the main reasonfor the failure of cross-border M&A is cultural differences and considered theimplementation of a post-merger cultural integration strategy to be the key to thesuccess of M&A.

...............................

3.1 Introduction of LT Company............................18

3.2 The Development Status and Product Characteristics in Kitchenware and TablewareIndustry....................... 20

4 ANALYSIS OF PROBLEMS AND CAUSES IN SUPPLIER INTEGRATION AFTERM&A..................................................26

4.1 Problems in the Process of Supplier Integration..................................26

4.1.1 Complex Internal Procurement Organization and Process..................... 26

4.1.2 Lack Sharing of Procurement and Supplier Information Resources...................28

5 PROPOSAL FOR SUPPLIER INTEGRATION AFTER M&A........................................... 39

5.1 Objectives and Principles of Supplier Integration..................................39

5.1.1 Integration Objectives..............................39

5.1.2 Integration Principles...................................39

6 IMPLEMENTATION EFFECTS OF THE PROPOSAL

6.1 The Total Procurement Cost Reduced

The total procurement cost in LT China can be divided into the direct procurementcost and the indirect procurement cost. The direct procurement cost is the purchasecost of products obtained from suppliers; and the indirect procurement cost includesthe organization and management cost of the procurement centers, and related cost ofproduct quality control (the costs incurred after goods on board are not included here).Following costs can be reduced after further supplier integration.

(1) Through the restructuring of procurement centers, the Dongguan and Shenzhenprocurement centers were integrated into the Guangzhou Procurement Center, whichhas reduced the overall procurement organization cost and procurement operating cost,saving up to 15% comparing to the period before restructuring.

(2) After combination of the procurement departments, it will save the travel expenseof the procurement staff for cross-regional and long-distance travel. The procurementmanagement cost can be reasonably controlled, expecting to save up to 5% comparingto the period before restructuring.

(3) The sharing of supplier resources can be improved after the restructuring ofprocurement centers and departments, and the integration of procurement and supplierinformation system, so the opportunities for centralized procurement will be increased,and the bargaining power of procurement can be further strengthened, in this situation,the direct procurement cost will be saved accordingly.

.........................

7 Research Conclusions and Prospects

7.1 Research Conclusions

Every merger and acquisition made by a large multinational trading company will addnew products, brands or markets to the company, in the meantime, it will also bring innew organizational departments, personnel and management culture to the company,thus, it will make the supply chain operation more complicated, especially aftercross-border mergers and acquisitions, and the difficulty in procurement and suppliermanagement will grow significantly. Since procurement and supplier management isthe core part of the supply chain management in multinational trading companies, theweak integration of the procurement and supplier system will greatly affect theoperational efficiency of supply chain and the performance of mergers andacquisitions.

Based on the analysis on the procurement and supplier integration of LT Companyafter mergers and acquisitions, this paper makes a theoretical and practical study onhow to combine the integration of the internal procurement system and the externalsupplier system, and puts forward optimization suggestions for supplier integration, inorder to improve the efficiency of supplier management and reduce the totalprocurement cost. The specific conclusions of this study are summarized as below.

(1) In the process of supplier integration, the selection and evaluation of suppliersshould be considered with the diversity of product categories, brands and salesmarkets after M&A. Large multinational trading companies are rich in productcategories, but the production processes of products are different from each other, sothe selection and integration of suppliers should come with different requirements. Inaddition, the quality requirements of high-end brands and low-end brands are quitedifferent, in the process of supplier integration, it is required to distinguish the realproduction capabilities of suppliers to preserve the brand reputation. Moreover, thepurchase volumes, quality requirements and products designs are various in differentregional markets, the level of supply must be maintained to facilitate the businessdevelopments in each market.

reference(omitted)