留学生市场作业Africa: Prospects and Challenges Tutor: Collins Osei

Introduction

Overview

Ideology

Political Environment

Socio-cultural Factors

Economic Factors

Climatic Factors

Investment Challenges

Investment Opportunities

MNCs and Success Stories

Summary

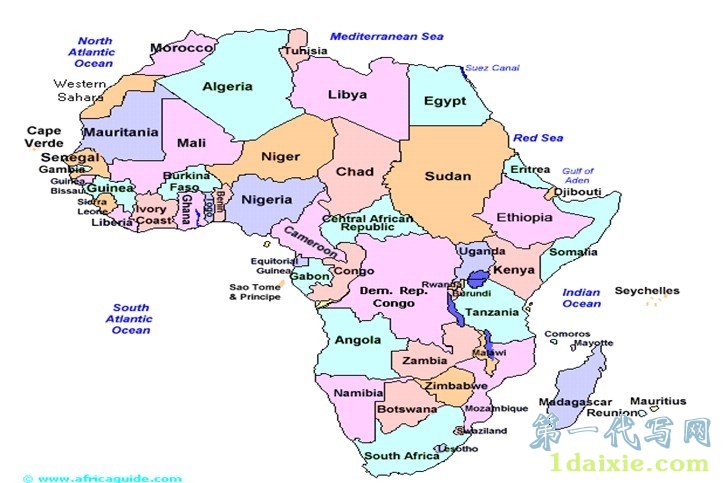

Map of Africa

Overview

Africa is the second largest continent – over 30 million km², and over 20% of total land area.

Hosts about 15% of the worlds population.

54 countries within the continent

Normally associated and sometimes erroneously with poverty

Still relies heavily on Agriculture industry, natural resources and aid

Continent working towards economic and political integration, economic recovery

Investments from former colonial masters, China, India

Ideological Factors

High dependence on foreign aid – the World Band, IMF, Western countries

Collective ownership of resources as opposed to capitalism

Beliefs and effects of emigration

High dependence on foreign aid – the World Band, IMF, Western countries

Collective ownership of resources as opposed to capitalism

Beliefs and effects of emigration

Political Environment

With the exception of Burundi and Rwanda Countries follow inherited borders from colonial past

State may comprise historic enemies

Same family may be found within two sovereign states

Inevitable ethnic conflicts, e. g, Nigerian ethnic conflicts involving Muslim North, Yoruba of South West and Ijaw and Itsekiri of oil-rich delta region

Improving political stability

Political integration

Recognition of legitimacy of traditional rulers

Political Environment

With the exception of Burundi and Rwanda Countries follow inherited borders from colonial past

State may comprise historic enemies

Same family may be found within two sovereign states

Inevitable ethnic conflicts, e. g, Nigerian ethnic conflicts involving Muslim North, Yoruba of South West and Ijaw and Itsekiri of oil-rich delta region

Improving political stability

Political integration

Recognition of legitimacy of traditional rulers

National Languages adopted from colonial past, English, French, Portuguese, Italian

Native languages

Healthcare

Improved life expectancy

Public and private investment in healthcare

Education

The Role of the elderly in societies

External family system

Migration to cities

Socio-Cultural Environment

National Languages adopted from colonial past, English, French, Portuguese, Italian

Native languages

Healthcare

Improved life expectancy

Public and private investment in healthcare

Education

The Role of the elderly in societies

External family system

Migration to cities

Effects of the rise of the African middle class

Exploitation of the potentials from natural resources

Large economic activity on the periphery

Inaccurate budget and estimates, e.g. over optimistic budgets

High Inflation

Balance of payment Deficit.

Illiquidity, weak stock exchange

Low domestic savings rates

Regional Integration, e.g. ECOWAS, COMESA, ASEA, NEPAD

Weak and contrasting regulations

Weak but improving economies of agglomeration

Speed of acceptance of technology, especially since 1999, e.g. Vodafone’s launch of Blackberry in Ghana in 2010 – part of ‘power to you’ campaign

Global access to expertise, e.g. hosting overseas to overcome local weakness

E-commerce, e.g. EthioGift

Internet banking

Investment Opportunities

Agriculture and related industries

Oil and natural resources

Banking and Finance

Telephony

Tourism

Real Estate

General Retail

Infrastructural development

Healthcare

Improved purchasing Power

Good Return on Investment compared to the average 7.3% for EM

Countries embracing democracy

Improved technology

Foreign direct investment in Africa

Access to Foreign markets

Improvement in Infrastructure

Improved literacy

Improved security

SABMiller (brewers) – located worldwide

Listed on London Stock Exchange

Sappi (paper) – UK, Hungary, Poland, Belgium, Switzerland, Africa

Listed on New York Stock Exchange

MTN (telephone network providers) - Middle East and Africa

Ecobank – Kenya and West Africa

Efforts to attracting Investment

Privatization

Establishment of Investment agencies

Incentives, e.g. tax holidays and tax allowances

Bilateral and multilateral relations

Nation branding/rebranding

Liberalization/Structural Adjusted Programme

Rationalization of tariffs, e.g. average tariffs reduced by 40% 1995-2006

Reduction of non-trade measures.

Investment Challenges

Bureaucracy – takes longer to register businesses

Weak purchasing power

Inadequate Infrastructure

Skilled labour

Stock Exchange and illiquidity

Political instability

Problems of co-branding

Corruption

Technology

Land grabbing

Deforestation and afforestation

Desertification

Water sources

Temperatures

Summary

Investment opportunities exist for innovative organisations

Growth rates rising but from a low base.

Economic reform taking place, but more to be done

Protectionism exists but easing

South Africa and Egypt lead in industrialisation, stock market

Improvement in political stability

Security remains an issue, e.g. piracy, kidnapping, war